Throughout the recent federal election campaign, the Canada Home Builders’ Association worked diligently to put, and keep, housing affordability front and centre. All parties addressed housing affordability in some way, often adopting CHBA recommendations in full or in part. The importance of making life more affordable for Canadians was also addressed in the December 5, 2019 Speech from the Throne, signaling a continued focus by the federal government on this essential issue.

The Association is committed to ensuring that Canadians have access to homes that meet their needs, at a price they can afford to pay, and that the interests of homebuyers and homeowners are understood by governments. The residential construction sector does this while also contributing over 1.2 million jobs, and $77 billion in wages to Canada’s economy. We will strive to keep housing affordability near the top of the political and policy agenda as Parliament resumes.

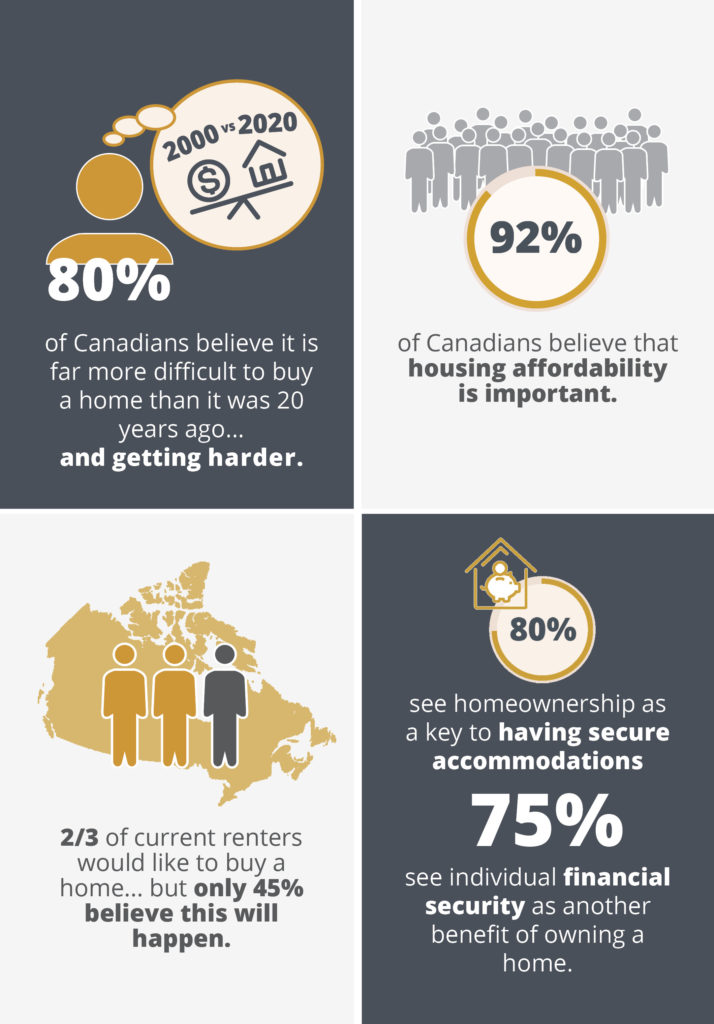

Data Continues to Show Majority of Canadians Strive for Homeownership

We must also work hard to ensure that the value Canadians place on homeownership isn’t lost on policymakers. In a poll of Canadians conducted this summer, the importance of homeownership to Canadians was clear:

Source: Online survey, August 19-26, 2019; Leger Marketing via Earnscliffe Strategy Group for CHBA.

The individual financial benefits of homeownership have been carefully examined and indicate that a homeowner is 9.6 times better off financially over time than a renter. This is even true when you don’t include any increase in value of your home.

In many cases, the monthly cost of owning is now lower than that of renting, as shown by Mortgage Professionals Canada in a recent study. The “forced savings” function of a mortgage through the repayment of principle has immediate and long-term financial benefits. Mortgage “debt” is very different from an auto-loan, credit card, store card, or unsecured personal line of credit. The financial benefits of a mortgage clearly need to be considered separately from consumer debt, as is well articulated in a report by Will Dunning for Mortgage Professionals Canada. And locking Canadians out of homeownership has negative financial impacts for those would-be first-time buyers, renters, and society at large.

Balancing Canadians’ Homeownership Aspirations with Financial System Risk

CHBA recognizes a necessity to balance the needs and aspirations of Canadians with risks like high household debt and rising house prices that are disconnected from income growth. It is important to note that the two are not mutually exclusive, and a better approach than the status quo is needed. A respectful dialogue and nuanced assessments of policies from a variety of perspectives can help deliver that delicate balance.

Supporting those who aspire to homeownership can improve housing affordability for all Canadians, including renters, low-income, and vulnerable individuals and families. Excessively restricting homeownership options, especially for first-time buyers, puts immense pressure on the rental market. Others can be locked into community or social housing if affordable market options are not vacated by those moving into homeownership. CHBA works closely with housing advocates across the housing continuum because we recognize the complexity of the housing system.

As Parliamentarians return to Ottawa, we continue to call for respectful dialogue to work towards smart and sensible solutions that will help Canadians access homeownership. Find out what these recommendations are here.