Canadians have long considered owning a home as a life milestone and a key to future financial security. But housing affordability has deteriorated over the past decade, an issue that intensified during the pandemic and continues today with higher interest rates and Canada’s housing shortage. Homeownership is under threat, and Canadians – especially young Canadians – are feeling like they may never be able to own a home.

Housing affordability is more than just the price of the home. It’s actually driven by three main factors:

- The income of the potential buyer(s)

- House prices

- Mortgage rules

These three factors all determine what is “affordable” to a buyer. Housing affordability is a balancing act. If incomes don’t keep up with the pace of inflation, if house prices rise too quickly, or if mortgage rules don’t allow for well-qualified buyers to purchase a home, then the balance is broken and affordability suffers. And that’s what Canadians are experiencing now. According to the Canadian Real Estate Association’s Composite Home Price Index, the average house price rose 35% from 2019 to 2023. We’ve also seen interest rates rise dramatically over the last year, and wages have not kept up. The result is affordability challenges for many aspiring home buyers.

Breaking down factors affecting affordability

Let’s look more closely at some of the specific factors that are negatively impacting housing affordability in Canada in 2023.

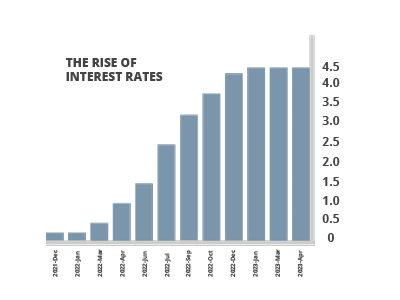

Higher Interest Rates

Higher interest rates have increased the carrying costs for mortgages, reducing affordability and knocking many buyers out of the market. Financing costs for construction are also higher, which increases overall construction costs. Delays in municipal processes, and delays in materials and labour, are further extending financing periods at these high rates, compounding the impact.

Lack of Housing Supply

Canada’s chronic lack of supply is now well documented. The need for more homes continues to be driven by a large millennial cohort household formation and increased immigration levels (which are now the highest in the G7 and needed to fill the labour shortage). This imbalance of supply and demand continues to drive up prices in both new construction homes and existing housing.

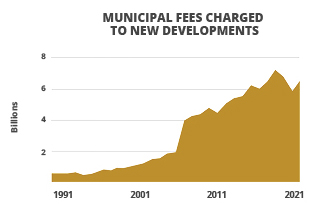

Development Taxes

Development taxes (development charges, lot levies, amenity fees, etc.) have risen dramatically in recent years. Total government-imposed taxes on houses now can be as high as 25% of the sale price.

Red Tape Delays & NIMBY

The number of government processes and regulations, as well as inefficiencies or lack of capacity, habitually delay projects, slow down development and significantly increase costs. Often, development that aligns with municipal plans is delayed or derailed by local resident opposition (NIMBYism), driving up housing prices.

Expensive Changes to Codes and Standards

Proposed code changes, for a variety of broad policy goals—sometimes good, sometimes excessive—continually add to the cost of construction, and this is reflected in higher prices for new homebuyers.

Higher Labour and Material Costs

Construction costs increased substantially through the pandemic and have not receded. While lumber has come down from record highs, other materials are still much more expensive. According to CHBA’s Housing Market Index, labour costs are up 28% and the construction material costs for a typical 2,400 sq.ft. home are still up $70,000.

What is Needed

Canadians need equilibrium returned to housing affordability. We need to ensure that well-qualified buyers can buy a home they can afford and that meets their needs. We need more housing supply to help meet demand and avoid rapid house price escalation. We need mortgage rules that strike the right balance between avoiding excessive debt and allowing responsible borrowers to finance what will likely be the biggest asset of their lives and a key part of retirement and financial planning: their home.

Right now, well-qualified, well-employed individuals and families are being squeezed out of homeownership. Their earnings are going towards paying rent instead of a mortgage, and those rent prices keep escalating. They are not building equity, and they are not reaping the benefits of the forced-savings approach homeownership provides. Rent prices are going up due to the demand, and as the cost of renting rises, more and more people will need social housing.

All levels of government have a role in turning the tide. And the federal government can be a key player to unlock the door to homeownership, and in doing so help all Canadians. Read more about how the government can help.