Housing affordability affects us all. Whether you want to buy your first home, or you’re struggling to pay rent, or you want your children to be able to live in the same area they grew up in – but are currently priced out of – housing affordability affects you.

The federal government has recognized that Canada needs to build 3.5 million additional homes over and above the 2.3 million we would normally build in the next ten years to house Canadians and address affordability. That’s 5.8 million homes. But housing starts are slowing at a time when the opposite is needed to increase housing supply. And the lack of homes available is driving up house and rental prices.

Why are housing starts slowing? Rising and sustained interest rates have had a devastating impact on new homes sales, and as a result, construction has slowed. CHBA’s Housing Market Index, which reflects industry sentiment through sales and sales centre traffic, indicates that builders are building fewer units and cancelling projects, suggests housing starts will begin trending downward even more severely in 2024.

Interest rates and other policy barriers are currently keeping the residential construction industry from being able to double housing starts and correct Canada’s housing shortage. But there are solutions.

The Role of Government

All levels of government have a role to play. Governments should help provide a stable market in which prospective homebuyers have reasonable access to homeownership, and in which those who rent do so because it’s truly their best option based on affordability and preference.

Remember that housing is a continuum, and that ensuring a healthy market for the 4 in 5 Canadian renters who want to buy a home frees up space and resources for Canadians who truly need them. The federal government can play a key role by supporting policies that will improve housing affordability and, in turn, foster an environment conducive to increasing housing supply. If the financial and policy environments change to enable much more production, we will not have enough workers to double housing starts. We also need changes to the immigration system and productivity to make it happen.

Policies that will improve housing affordability and, in turn, increase supply

So what measures can improve housing affordability? Solutions will come in the form of measures to improve housing supply so that demand doesn’t keep driving up prices, which will take federal leadership with a holistic approach. They’ll come from lowering interest rates as soon as possible. They’ll come from smarter mortgage rules that address risks without locking too many Canadians out of homeownership, especially first-time buyers. They’ll come from lowering government-imposed costs that are currently adding to affordability challenges and removing barriers within the home building process that are making it harder to build homes. And they’ll come from supporting the residential construction industry to help keep it building and renovating—from supporting the workforce through immigration and training, to investing in increased productivity in the sector.

At the Canadian Home Builders’ Association, we study how housing in Canada works, and we strive to ensure Canadians have access to the homes that meet their needs at a price they can afford. A healthy housing market is good for this key industry that creates so many jobs, yes. But it’s also good for Canadians, and it’s why we’re passionate.

The following policies can unlock the door to homeownership and improve housing affordability:

1. CONTINUE FEDERAL LEADERSHIP, BUT WITH A HOLISTIC APPROACH – to increase market-rate supply and improve affordability

Canada is short 3.5 million homes.

We need more of the right kind of housing, in the right places. When there isn’t enough supply of the types of homes that people want to buy, house prices go up by too much, and too quickly. The government analysis and goal-setting of doubling housing production to make up the 3.5 million unit housing deficit in the next decade—on top of 2.3 million homes we would normally build in that time—has been very helpful and needs to continue.

The government also needs to ensure its own economic policies do not run counter to efforts to increase housing supply. For example, government action on interest rates, mortgage rules, red tape, taxation, and codes and standards should be viewed holistically, keeping in mind the goal of building more homes. The federal government and its related institutions (Canada Mortgage and Housing Corporation (CMHC), the Bank of Canada, and the Office of the Superintendent of Financial Institutions (OSFI)) should work in close consultation to ensure their collective actions support more housing supply and do not inadvertently stifle growth.

Recommendations:

- Continue to pursue the doubling of housing starts to make up the 3.5 million unit housing deficit.

- Continue to lead collaboration with provincial and municipal levels of government to use all levers to improve housing affordability and increase housing supply.

- Continue and increase capacity to put out objective information and data about housing affordability and housing supply through CMHC and Statistics Canada.

2. REMOVE BARRIERS TO HOMEOWNERSHIP FOR FIRST-TIME BUYERS

There are three factors that determine housing affordability: the person’s income, the mortgage rules in play, and the price of the home. Wages have not kept up with today’s high home prices and interest rates, and first-time buyers are inordinately affected by mortgage rules, especially those to insured mortgages, yet they are the lowest-risk group of buyers. They’re also the financial future of Canada. They’re starting their careers and their salaries are just beginning to grow.

Rising mortgage rates and ever-tightening mortgage rules have made access to homeownership for first-time buyers more and more difficult. If they’re not buying homes, it reduces the industry’s ability to build more homes. It doesn’t mean that the demand for more homes has gone down, but rather that it’s been artificially repressed. And when young people and new Canadians who want to own homes can’t move out of rental units, it puts more pressure on the rental market, driving up rental prices. A healthy housing continuum includes robust market rate housing options, and diverse pathways to homeownership, supported by sound mortgage policies.

Mortgage rules have been so tightened that homeownership rates have been falling severely since 2011, especially for people under 30 (Statistics Canada). This has been done in the name of financial sector stability, yet mortgage arrears of 0.22% are at near historic lows, well below their long-term average of 0.33% (Canadian Bankers Association), and 5 times less than the current US rates of 1.19%!

The cost of over-tightening mortgage rules has been a severe drop in homeownership rates, with a 2.5% drop since 2011 (likely more by now), equating to 1 million more Canadians now renting instead of owning.

With the bond market still elevated, 5-year mortgage rates are dropping much less than the Bank of Canada rate, making more mortgage reform as important as ever.

We need to help young people overcome today’s obstacles to homeownership. And since one of the biggest obstacles – high home prices – is caused by a lack of supply, the key issue of housing supply should be considered in all monetary and regulatory policy (e.g. any actions by the Bank of Canada, Finance/CMHC, and OSFI).

In tandem, improvements should be made to construction financing so that builders can build more homes, creating housing stock that is attainably-priced for first-time buyers.

Recommendations:

- Continue lowering interest rates, with an eye to getting new construction ramped up.

- Make the stress test dynamic for both insured mortgages (Dept. of Finance) and uninsured mortgages (OSFI) so it is lower at higher mortgage rates. Note: The current government has committed to review the stress test.

- Direct OSFI to avoid further changes to OSFI B-20 guidelines that make it even harder to qualify for a mortgage.

- Adjust the Interest Act to facilitate 7- and 10-year mortgages and remove the stress test on them.

- Maintain the 30-year amortization period now available on insured mortgages for new construction and first-time buyers, and index the $1.5 million price cap with inflation annually.

- Increase Limits on First Home Savings Accounts to $75,000 total and $10,000 annually.

- Require OSFI to step back from implementing Basel IV – the accelerated timeline will further restrict lending capacity, which means less financing of new homes (for construction, productivity investment, and mortgages).

- Implement CMHC Construction Financing, including low-interest financing for market-rate housing for ownership from the government, plus a new construction loan insurance program.

- Revisit regulations that inhibit needed foreign investment in development, especially in Canada’s largest centres which critically need supply.

3. LOWER GOVERNMENT-IMPOSED COSTS THAT ADD TO AFFORDABILITY CHALLENGES

Government taxes and fees are a major contributor to high house prices, making up as much as 31 percent of the sale price of a home in some regions.

The federal government should use all its levers to assist municipalities in reducing their development taxes (which get passed on to developers and—ultimately—homebuyers) by increasing housing-supportive infrastructure and transit investments and tie them to housing supply outcomes.

The Federal Government can help affordability by lowering the GST on new homes. House prices have increased substantially since the GST was introduced in 1991. The New Housing Price Index, which measures the change in newly constructed house prices over homes, was 56 in 1991. It’s now 125—more than double. It is time to increase the thresholds of the ST/HST New Housing Rebate to reflect the increased price of housing today. When the GST was first introduced, the federal government made a commitment to adjust the New Housing Rebate thresholds every two years to reflect changes in housing prices, and thus to protect affordability over time (see Technical Paper on the GST, 1989, pg.19). However, those thresholds have never changed. They are currently $350,000 for the full rebate, reducing to $0 for anything over $450,000. Since the New Housing Price Index has more than doubled since 1991, the rebate thresholds should therefore be doubled as well, to $700,000 and $900,000. To further help affordability for Canadians who helping achieve Canada’s climate change goals, Net Zero Energy and Net Zero Energy Ready home renovations should be made eligible as “substantial renovations” to qualify for the GST/HST New Housing Rebate.

Recommendations:

- Continue to work with municipalities and provinces, and use all federal levers, to reduce development taxes. (See “Support Housing Supportive Infrastructure” below.)

- Lower GST on New Homes:

- Eliminate the GST on homes less than $1M, and have a declining rebate for homes up to $1.5M.

- Increase limits to $1.5M and $2.0M in expensive markets.

- Index GST limits with inflation annually moving forward.

- Include all Accessory Dwelling Units and Secondary Suites as eligible for these new construction GST waivers, given they are new housing units.

- Maintain removal of GST on Purpose-Built Rental

- Make Net Zero Energy and Net Zero Energy Ready retrofits eligible as “substantial renovations” to qualify for the GST/HST New Housing Rebate.

4. SUPPORT HOUSING-SUPPORTIVE INFRASTRUCTURE

Recommendations:

- Maintain and increase housing-supportive infrastructure and transit investments (to lower municipal development taxes which get passed on to homebuyers) and tie them to housing affordability and supply outcomes (e.g. requirements to freeze or lower development taxes, increase density, reduce parking requirements).

- Work with provinces and municipalities to mandate that alternatives to development taxes be found and implemented so that development taxes are lowered. Alternative solutions include:

- Municipal debt financing, including shifting some charges to property taxes, particularly for services that benefit the wider community (beyond the new development) such as libraries, roads, and new fire stations.

- Implementing user charges for certain services (e.g. water and wastewater).

- Adopting land value capture techniques for transit improvements.

- Community development districts.

- Updating provincial development tax legislation

4. REMOVE BARRIERS AND RED TAPE WITHIN THE HOME BUILDING PROCESS

Barriers within the home building process result in delays and building more homes more difficult and costly, which in turn impacts housing affordability and the industry’s ability to build more homes. The government has recognized Canada’s shortage of 3.5 million homes over the next decade, and all levels of government should be trying to remove barriers within the home building process in order to facilitate increasing Canada’s housing stock.

The government should keep working with municipalities to get more homes built. It should also make sure its own actions do not make homes even more difficult to build by fixing unnecessary federal red tape that are making home more expensive and placing an extra unnecessary burden on home builders.

Recommendations:

- Continue to work with municipalities to support and/or require municipal process improvements tied to housing supply outcomes (e.g. zoning, bylaws, approval/permitting delays, NIMBYism).

- Put all federal legislation through a housing supply and affordability lens, including the small business lens of the home building industry and adjust accordingly.

- Ensure all federal departments and agencies (CMHC, the Bank of Canada, OSFI, NRC) work in close consultation to ensure more federal red tape is not heaped on the residential construction industry.

- Eliminate and avoid inappropriate federal red tape on residential construction.

- Examples of inappropriate red tape the federal government has implemented that required major changes to avoid encumbering the residential construction industry:

- Underused Housing Tax

- Forced Labour in Supply Chains Reporting Requirements

- Trust Reporting Requirements.

- Examples of ongoing inappropriate red tape include duplicative or excessive environmental legislation preventing, slowing, or increasing costs of development.

- Examples of inappropriate red tape the federal government has implemented that required major changes to avoid encumbering the residential construction industry:

5. AVOID ADDING COSTS THROUGH CODES AND REGULATIONS

Many new policy directions that put pressures for more stringent codes and regulations (e.g. climate change mitigation, resiliency, accessibility and others) are very important, but expensive. Unfortunately, almost all short-term actions to address these policy priorities through regulation increase costs to housing. It is critical to innovate and find solutions to these challenges without driving up housing costs.

CHBA is actively driving innovation within the sector. We’re engaged in the pursuit of affordable solutions through our CHBA Net Zero Energy Home Labelling Program, which has labelled over 2600 homes, as well as through many other areas, such as climate change adaptation and resilience.

In addition, it’s important to recognize that today’s new homes are already very efficient (and will continue to become even more efficient). But to address climate change within the sector, it’s critical to address the existing housing stock through energy retrofits during home renovations. CHBA’s Net Zero Home Labelling Program includes renovations to address this need.

It is important to invest in R&D to find energy efficiency measures that do not reduce affordability. The government should focus on neutral-cost innovation to bring down costs and scale up use first, before regulating excessively high levels of energy performance. CHBA cautions against adding excessive costs through code and/or regulation that will impact housing affordability in Canada, at a time when home is more important than ever. Better solutions can be and should be found first to improve affordability for consumers, not make it worse.

CHBA recommends having the EnerGuide Rating System (ERS) label on all houses at the time of resale to raise the energy literacy of Canadians, help home valuations truly reflect energy efficiency, and further encourage Canadians to make energy efficiency and retrofit investments on an accelerated pace in ways they can afford. Consistency and clarity can help homeowners tackle climate change.

Recommendations:

- Adopt affordability as a core objective of the National Building Code and all related standards to ensure that we are building better, more efficient houses for the same price or less moving forward.

- Establish a National Building Code Interpretation Centre with interpretations that are binding for all municipal building officials.

- Work with provinces to harmonize all municipal building and development-related regulations to eliminate and prevent barriers to rapid deployment of housing.

- Reconstitute the Standing Committee on Housing and Small Buildings to more efficiently focus on housing (not commercial and institutional construction, and not across the new 13(!) committees.

- Invest in innovation and R&D for lower or neutral-cost solutions that promote energy efficiency, climate adaptation and resilience, accessibility, and health and safety.

- Do not regulate until cost-neutral innovations are available.

- Provide incentives for Net Zero Ready Homes, to reduce costs and accelerate technology development and adoption.

- Work with the provinces to have the EnerGuide Rating System (ERS) labels on all homes at time of resale.

- Provide incentives for home retrofits.

6. ADDRESS LABOUR SHORTAGES

Canada doesn’t have enough workers to meet the status quo, let along double housing starts, which is what is needed to build an additional 3.5 million homes over the next ten years, in addition to the 2.3 million homes that would typically be built in that time frame. If the financial and policy environments change to enable much more production, we will not have enough workers to double housing starts.

However, the construction industry continues to face chronic labour and skills shortages. BuildForce Canada outlines how an aging labour work force and the expected retirement of some 22% of the labour force by 2033, equating to approximately 128,000 workers. To build the 5.8 million homes needed, the residential construction workforce would need to grow by 83% above 2023 levels – to just under 1.04 million workers.

Current government funding and programming does not adequately address residential construction’s workforce challenges. It is important to remember that the home building sector is:

- Different from the industrial, commercial, and institutional construction (ICI) sector and has entirely separate needs.

- Largely made up of SMEs – many are microbusinesses with less than 5 employees.

- Largely not unionized (outside of the GTA and Quebec).

- Not adequately supported by the apprenticeship system.

Growing the domestic workforce

The government should do everything possible to encourage more Canadians to consider a careers in the skilled trades, and support the apprenticeship system to help interested go through the training needed for these skilled careers. There is significant opportunity to encourage groups traditionally underrepresented in the current construction labour force, including women, Indigenous people, and new Canadians. As a country, we need leadership to demonstrate these are good and valued jobs, and we need to support the people who work in them. The Canadian Home Builders’ Association is doing its part to promote the skilled trades and provide information to those looking to begin a career in residential construction. Visit our website for more information.

CHBA is proposing a Talent Pipeline Concierge Service for Employers. The goal of this initiative is to develop robust talent pipelines and sustained pathways that will attract workers into the residential construction sector to help employers hire and effectively onboard, as well as retain and promote, workers through the creation of local concierge services in locations across the country.

Recommendations:

- Invest in CHBA’s proposed “Talent Pipeline Concierge Service for Employers” to significantly ramp up workforce capacity, better match qualified workers with jobs in the sector, and respond to labour market needs.

- Through additional programming specific to the home building sector, encourage more Canadians to choose a career in residential construction, particularly youth, women, Indigenous populations, and other equity-deserving groups.

Updating the immigration system

CHBA fully appreciates that immigration puts pressure on Canada’s housing affordability challenges. But robust immigration pathways are imperative to address residential construction workforce shortages and build the homes needed to restore affordability.

CHBA understands that these recommendations represent a significant shift for Canada’s immigration eligibility, but are critical to meet Canada’s housing supply needs. Canada needs to target entrants with the right competencies, transferable experience, and desire to build a career in the sector.

Recommendations:

- Enhance category-based selection for Express Entry to support the specifics of the residential construction sector, including bringing in TEERs 3, 4, and 5 workers, such as installers, framers, and general labourers and helpers.

- Update the National Occupation Classification System to properly reflect occupations in residential construction (and reflect the differences between residential construction and institutional/commercial/industrial construction)

- Work with employers to facilitate labour market integration for newcomers and set them, businesses, and the sector up for long-term success. (See CHBA’s proposed

“Talent Pipeline Concierge Service for Employers”).

Supporting increased productivity

In addition to addressing labour shortages, increasing productivity in the industry is one of the necessary solutions. Moving the industry towards factory-built construction offers many benefits, but there are risks and barriers that have prevented the industry from transitioning to factory-built construction.

The site-built housing industry has evolved to successfully weather boom and bust cycles of the market/economy. Conversely, factory-built construction requires high capital investment, high overhead, a steady workforce, and steady demand/throughput, which means it’s not inherently well suited to boom and bust cycles. Costly up-front capital needed to invest in modular and other factory-built technologies means it’s a solution that requires government support in order to be widely adopted. Just as the federal government is supporting innovation in clean energy, so too should it invest in necessary solutions to help alleviate Canada’s chronic housing shortage.

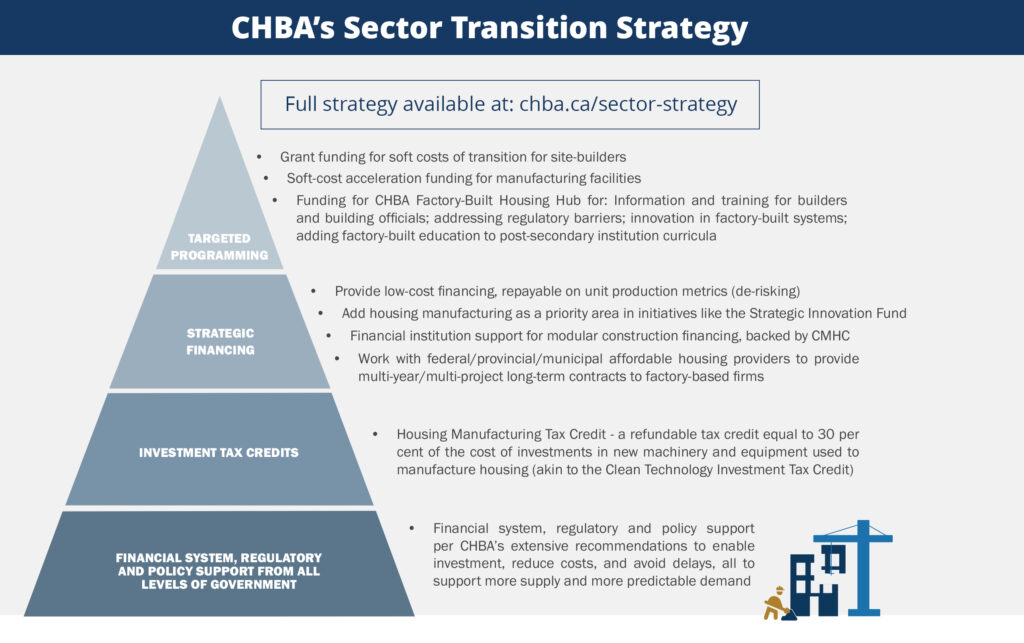

The Canadian Home Builders’ Association recognized the critical role of increased productivity within the sector. We have developed a Sector Transition Strategy to explain the current situation, the challenges and opportunities, and provide recommendations to get Canada using more factory-built construction.

Recommendations:

- Implement recommendations from CHBA’s Sector Transition Strategy, including:

- Financial system, regulatory and policy support from all levels of government to create a conducive business environment.

- Targeted programming for the transition.

- Strategic financing to de-risk investments.

- Investment tax credits to accelerate investment.

- Invest in CHBA’s proposed Factory-Built Construction Hub for: information and training for builders and building officials; addressing regulatory barriers; innovation in factory-built systems; a concierge service for government transition funding.

- Work with employers to facilitate labour market integration to attract, train, and retain workers in factory-built construction. (See CHBA’s proposed “Talent Pipeline Concierge Service for Employers”).

Next Steps

Housing affordability and housing supply are intrinsically tied, and both are complex issues, but as you can see, there are tangible things the federal government can do to improve the challenges that Canadians are facing.

And while there is a lot of information out there on how affordability works, not all of it is accurate. Check out our continually expanding Myths and FAQs page to see how much you know about housing affordability in Canada.